Microfinance: Pathway to Equality – From a small business of women to children’s education

By: Mr. Raymond Patrick Serios, Negros Women for Tomorrow Foundation, and Dr. Faiz Shah, President, Yunus Thailand on Wednesday, April 27, 2022

Microfinance, also called microcredit, is a type of banking service provided to unemployed or low-income individuals or groups who otherwise would have no other access to financial services. Its purpose is to help this group of people earn a living for themselves and their families by starting their own small businesses. The microfinance principle was the brainchild of Professor Mohammad Yunus, founder of Grameen Bank in Bangladesh in the 1970s, to help poor housewives in Bangladesh earn extra income for their households. Negros Women for Tomorrow Foundation (NWTF) has been operating in the field of microfinance based on the Grameen principle for more than 40 years. NWTF has helped many people, especially women in Western Negros, the Philippines to achieve more self-sufficiency and self-reliance through a wide range of credit products and services, including education.

NWTF’s evolutionary journey is worth exploring: how it evolved from a small initiative to help women to Southeast Asia’s leading microfinance organization with great success in paving the way to equality through the provision of financial assistance and educational opportunities for children in the Philippines.

History of Negros Women for Tomorrow Foundation

NWTF started as Mother Bakery Cooperative – an initiative that helped mothers in Negros Occidental generate extra income from baking and selling bakery during the economic crisis in 1984. The group became a non-government organization known as NWTF in the late 1980s when the organization launched an official lending program for poor women called “Project Dunganon”, where the word Dunganon in the local language means dignity.

The program includes a wide range of credit products and financial services and other developments. The main product is General Loan, which is a low-interest loan that does not require collateral. When the borrower builds her credibility through continuous on-time repayment up to a certain period or when the borrower can prove her own “Dunganon”, she will then be offered other products and services of a higher level. These services relate to business development, capacity building, health, and education.

NWTF aims to be a sustainable institution of change by focusing on developing entrepreneurial skills in the poor so they become capable of making a living and being their own boss. Currently, NWTF has 195 branches, serving over 525,000 clients, employing over 3,500 employees with a loan portfolio worth over 80 million USD and an impressive repayment rate of 98 percent.

Grameen Bank’s Microfinance Principle: Key Success of NWTF

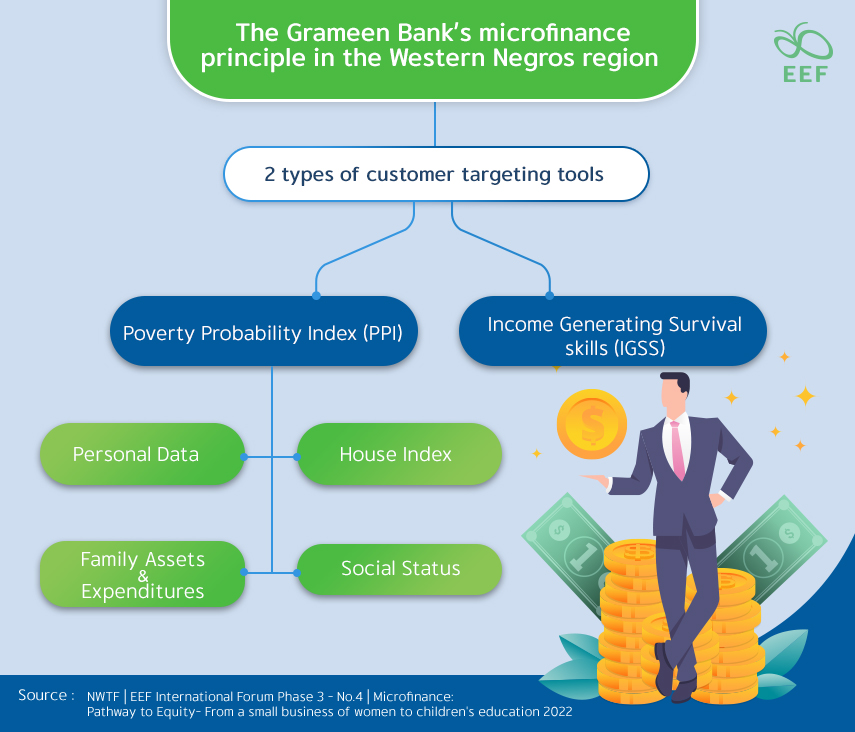

NWTF has successfully applied the Grameen Bank’s microfinance principle in the Western Negros region. The principle has the following key elements:

Proper Client Targeting to ensure that the beneficiaries of the loan are the group of poor people who truly need to improve their household’s economy. NWTF deploys two types of customer targeting tools, namely;

1. Poverty Probability Index (PPI): The PPI is a poverty scorecard used to determine a client’s household poverty status; it consists of four sections:

-

- Personal Data such as age, educational attainment, address, civil status, etc.

- House Index such as the structural condition of the house, roofing, and wall materials

- Family Assets & Expenditures

- Social Status. The aim is to examine the household’s level of income, employment status, and level of education. This five-minute interview provides data on the client’s household poverty status that is benchmarked against the country’s poverty line.

2. Income Generating Survival Skills (IGSS): The IGSS is a tool to be used with the selected potential member, based on the PPI results, and all the adult members of her household to ensure that the micro-loans will bring about the desired increase in household income. It is based on the potential capacity to pay rather than just the capacity to pay. Furthermore, the IGSS assesses the following factors: motivation to determine the plans and dreams of the potential clients, skills inventory, capital needed, amortization, and future business plan.

Management of microfinance using Groups and Centers as the core.

The purpose is to bring disadvantaged people into the fold of some organizational format where they can find socio-political and economic strength through mutual support. The Group is composed of five members and the Center is composed of 7 to 14 Groups. Members of the Group should be friends/neighbors living within walking distance from one another. Such formation of a Group and Center ensures business presence and continuity, monitoring and supporting each other’s loans, enforcing discipline and saving, etc.

Moreover, NWTF implements the laddered approach to lending, starting with a smaller loan. Once the client demonstrates a certain level of credit discipline, she will be given access to a larger loan including other PD loan products, and provision of various non-financial services such as health and wellness support, business development, green products loan, and education.

Microfinance and Education Opportunity

Microfinance and education are closely linked. Both are important tools to help the poor escape from life adversities. Microfinance provides the poor with access to funds that can be used as future income and to seek quality education for their children. In contrast, education can nurture skills and knowledge that can be transformed into opportunities for sustainable access to funding. One of the goals of Grameen Bank’s principle and NWTF is to pave the way for equality by providing universal access to finance and education. When a family achieves a certain level of financial stability, it will be able to seek quality education for its children to further improve the educational and financial standards of the household.

As an example of microfinance and education development, NWTF offers a credit product called “Balik Eskwela” to help mitigate the expenses of the clients in their children’s education. To develop financial discipline, however, the product imposes that certain conditions be satisfied before one is eligible for the services. One such condition requires that the main loan be repaid. Upon reaching the third or the fourth cycle of borrowing and the clients are able to build credit discipline, they are given access to other PD loan products. Other conditions require that the borrower’s children remain in the education system on an ongoing basis and not leave school prematurely. Various scholarship programs are also available for local children.

Through the provision of loans and scholarships, the Grameen Bank itself has helped countless low-income earners become self-sufficient and break the cycle of poverty and social exclusion. In many countries, microcredit and other forms of financial assistance have been proven effective in helping children, especially girls. Among the benefits, they can enjoy better education, improved nutrition and well-being, reduced gender bias, and more opportunities to liberate themselves from poverty.

—————————————————————————-

Lead Discussion: Microfinance and Reducing Educational Disparities in the Thai Context

By Mr. Idh Pukkanthorn, Senior Program Administrator in Innovation, Scholarships and International Affairs, Equitable Education Fund

Currently, in Thailand 1.8 million children aged 6-14 years are not in the education system, more than 430,000 of whom are out of the education system due to poverty. It was also found that the gap in access to education was a 20-fold difference between the lowest 10% and the highest 10% household income groups. Moreover, it is estimated that another 300,000 or more underprivileged children have been added to the number by the COVID-19 pandemic. These statistics indicate that the country’s inequality in education is particularly worrying.

With the implementation of career development projects for the poor and underprivileged using the community as a base by the EEF since 2021, we discovered that the main obstacles in the delivery of funds for organizing activities lay in the broad scope of work that covered small units such as families, communities, to government agencies at both local and central levels. This process complicated capital management. Shortage of funding sources was never a problem for Thailand, yet we were unable to effectively deliver those funds to the target group successfully. One solution to this problem is to redirect operations that originally started centrally to the local level by way of decentralizing the power to various communities. This will allow the target communities themselves to cooperate with local occupational development agencies. After that, they can coordinate with the local EEF network to begin processing the grants by assessing the existing capital of the community in three aspects, namely, social capital, resource capital, and network capital. This approach is comparable to the establishment of NWTF’s Group and Center credit management. Currently, the project has reached a target beneficiary group of over 25,000 people through more than 350 projects across the country.

Watch EEF Int’Forum Record:

Part1: https://youtu.be/QfYiWP3lkI4

Part:2: https://youtu.be/_y0Baj1uunw

Source:

EEF International Forum Phase 3 – No.4 l Microfinance: Pathway to Equality – From a small business of women to children’s education l 2022